Child killer Letecia Stauch took out a $25k life insurance policy on stepson years before murder

COLORADO SPRINGS, Colo. (KRDO) -- Federal court documents obtained exclusively by 13 Investigates reveal that convicted child killer Letecia Stauch took out a life insurance policy on her 11-year-old stepson two years before murdering him.

These details are coming to light from a battle between USAA and Stauch happening in federal court, just two weeks after Stauch was found guilty on all counts connected to Gannon Stauch's murder.

According to court documents, Stauch bought the "Child Rider" insurance policy on June 11, 2017. The policy would allow Stauch to collect $25,000 after Gannon's death. But now, USAA is asking a federal judge to decide where that money should go.

USAA also filed a federal lawsuit against Stauch and Gannon's biological parents, Al Stauch and Landen Hiott. The financial services company claims the "felonious killing" of Gannon should not allow his murderer to profit from his death. USAA says it's an "innocent stakeholder," which prompted them to petition the courts to decide who should recoup the death benefit.

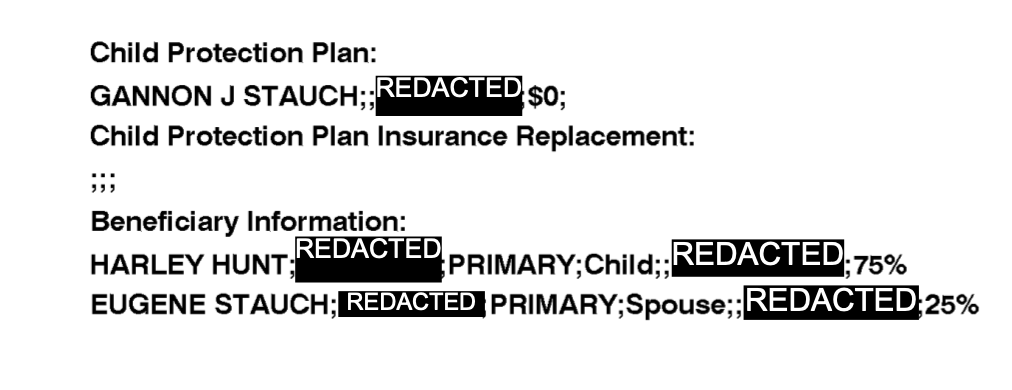

Court documents reveal that Stauch set the policy up to include who should be the beneficiary of the money if Gannon were to die. The plan included 75% to Stauch's biological daughter, Harley Hunt, and 25% to her ex-husband Eugene "Al" Stauch, Gannon's biological father.

However, on the day Stauch was arrested for Gannon's murder, she asked USAA to change that beneficiary information to remove Al. At the request of Stauch, on March 3, 2020, USAA changed this information to make Hunt the sole beneficiary of these life insurance funds.

In an interview, after Stauch was convicted of murdering his son, Al said he wants zero connection to his ex-wife. To emphasize that point, he said that he and his family will not be seeking restitution from her for this very reason.

"That opportunity would be there for us to seek restitution for all the losses and my losses are tremendous. My losses are well in the six figures, but I would and this is maybe my stubbornness, but I would rather pay every cent of those losses back than be connected with her," Al said.

In federal court documents, an attorney for Al and Hiott said they do not object to the federal courts keeping the money until a judge decides who the money should go to.

13 Investigates spoke with attorney Jeremy Loew, who explained why USAA is taking these steps to determine who should collect the life insurance money.

"When you take out an insurance policy, the insurance company has an obligation to pay on that policy. If they don't pay on that policy, the insurance company can be sued for triple damages," Loew said. "They've essentially given the money to the court and they've asked the court to decide who the money should go to if anybody at all."

A federal court judge has filed an order to command USAA to pay the $25,000 to a "treasury registry" with the court. Now, the judge is tasked with determining if the money should go back to USAA or a rightful owner.

However, as Loew explains, someone cannot recoup life insurance money after being convicted of killing that person.

"You can't take a life insurance policy out against someone and then murder them for the money. That's not allowed. It seems to be what occurred in this case," Loew said.

Loew said parents taking life insurance policies out on their children, or in this case, step-children are highly unusual. He said this is because children are typically not earning income, and if they were to pass away, that family is now on the hook for income losses.

"Gannon's life for those two and a half years with his stepmother must have been absolutely atrocious. You try and think that no one can be that conniving or manipulative, but at this point, who knows," Loew questioned.

USAA issued this statement regarding the life-insurance policy:

“This is a tragic situation and USAA has given the proceeds to the court to determine the appropriate recipient of the life insurance policy.”

Rebekah Nelson, USAA Spokesperson

Do you have a tip you want 13 investigates to look into? Email us at 13investigates@krdo.com