What is Proposition EE?

COLORADO SPRINGS, Colo. (KRDO) - Proposition EE proposes to increase taxes on cigarettes and tobacco products and would create a new tax on nicotine products which currently aren't taxed, like vaping products,.

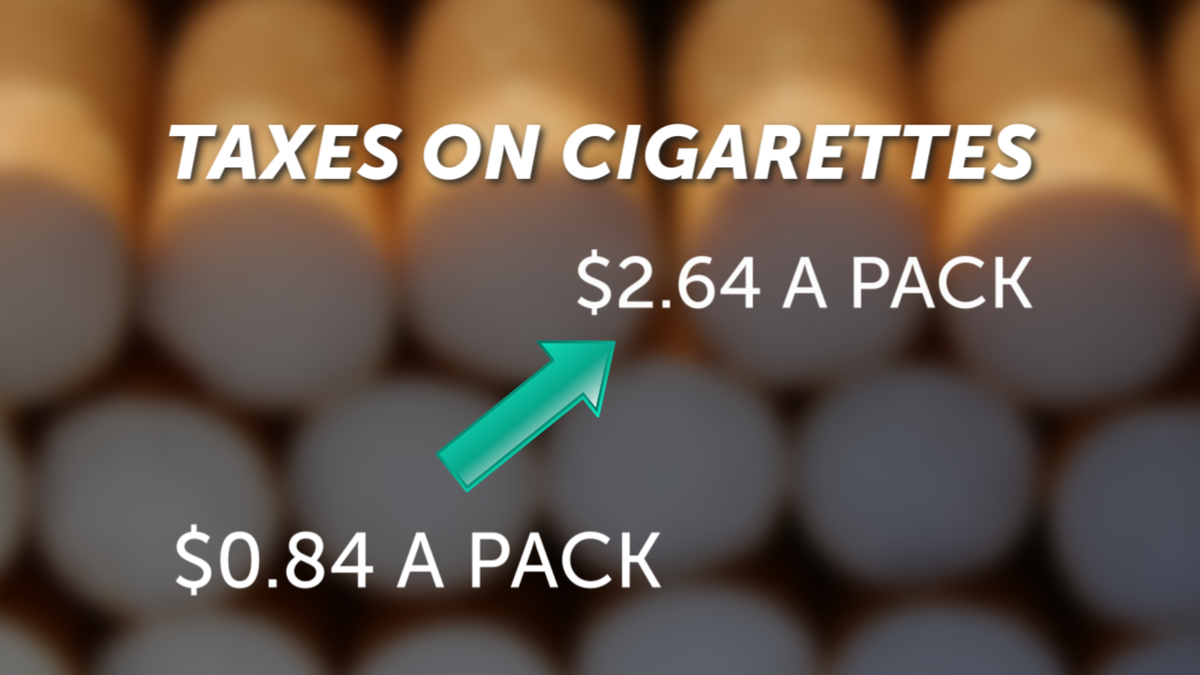

If Proposition EE is passed, taxes on cigarettes would gradually increase from 84 cents per pack to $2.64 per pack by 2027.

Tobacco taxes would gradually increase from 40 percent to 62 percent during that same time.

Vaping products and devices that do not contain nicotine are not subject to the tax.

The proposition states that the new revenue would be distributed to the following areas:

- Expanded preschool programs

- K-12 education

- Rural schools

- Affordable housing

- Eviction assistance

- Tobacco education

- Health care

Proposition EE would provide funding for expanded preschool, including at least 10 hours per week of free preschool for every child in their final year before kindergarten.

Diane Price is the CEO of Early Connections Learning Centers and says there would be a huge benefit to offering expanded preschool programs.

"When we think about how we begin to curb smoking, push back smoking, and take some of that revenue and put it into children and families at those young ages, not only does preschool help in outcomes of school, but it helps in outcomes with their health, their mental health and social wellbeing," Price said.

Michelle Lyng with No on EE is on the other side of the debate.

"Proposition EE is a $249 million tax increase --the vast majority of which will be paid by those making $40,000 per year or less-- and this was done through a backroom deal with a sweetheart deal for big tobacco. The funding resulting from this proposition will not go to preschool for 2 1/2 years - if ever. This is a bad policy and voters should vote no," Lyng said.

Preschool funding is expected to begin during the 2023/2024 school year.

Arguments Against Proposition EE:

- The increased tax would impose a financial burden on people who consume tobacco and nicotine products, particularly low-income users.

- Youth vaping should be addressed through enforcement of existing age restrictions and additional education and prevention, not through raising taxes.

- The tax would hurt business owners who sell nicotine and tobacco products, it would particularly harm small, local businesses.

- The state should not be dependent on tax revenue from a specific addictive product to fund schools, preschool and other tax services.

"One of the worst features of Proposition EE is that it sets a price floor for cigarettes," Lyng went on. "Basically what that says is all cigarettes must be sold at $7.50 per pack."

Arguments For Proposition EE:

- The tax increase would deter smoking and tobacco use, especially among youth and young adults.

- The tax increase would provide needed funding for education at a time when public school funding is decreasing.

- The free preschool program would give all Colorado children the same foundation before entering kindergarten.

- High quality preschool is shown to improve educational, economic and health outcomes throughout a child's life.

"Colorado is a very healthy state with a lot of people making very healthy choices and this is an area we are not that great in. We have the lowest taxes on cigarettes and tobacco in the country," Price said.

A vote "yes" to Proposition EE means you are in favor of increasing taxes on tobacco and nicotine products.

A vote " no" to Proposition EE means you are against increasing taxes on tobacco and nicotine products.