Bills to come out of legislative special session affects property taxes, TABOR refund

DENVER, Colo. (KRDO) -- To finish the four-day special session, state legislatures passed multiple bills Monday that will affect your wallet in the form of property taxes and TABOR refunds.

Shortly after Proposition HH failed by nearly 20% in early November, Colorado Governor Jared Polis called a special session to come up with a solution to bring 2023 property tax relief to Coloradans, as property tax bills have increased by 40 to 50% for homeowners.

On Monday, a property tax relief bill was passed that will cut property tax increases in half. This is done by increasing the property value exemption for residential properties from $15,000 to $55,000 and decreasing the assessment rate from 6.765% down to 6.7%. The bill doesn’t include relief for non-residential properties.

For example, a $500,000 home will be valued at $445,000 with a $55,000 exemption. With the new assessment rate and the local mill levy, the homeowners will save about $200. These savings will vary depending on your home’s value and local mill levy rate. However, your property taxes won’t be lower than what they were last year. This relief bill only limits the increase caused by higher property values.

“Since most property owners pay their taxes through their mortgage payment every month, a $17 reduction in their mortgage payment per month may not be that noticeable,” said El Paso County Assessor Mark Flutcher.

This bill only helps limit property tax increases for the current tax year and doesn't include any long-term solutions, including capping property values. When asked what the solution is, Flutcher said that’s the “$1,000,000 question.”

“Capping values permanently may not be the best solution because again, you may create a disproportionate tax scheme,” he said. “It's something the legislature really needs to work hard on.”

This is why Democrat State Representative Marc Snyder sponsored a bipartisan bill to create a task force to find long-term solutions to the rising property tax issue.

“If we don't do something, we'll be right back in the same boat this time next year,” Snyder said. “I'm really hoping this 19-member task force will come up with some really good solutions.”

Both bills passed the special session, along with one that could change how much TABOR refund money you receive.

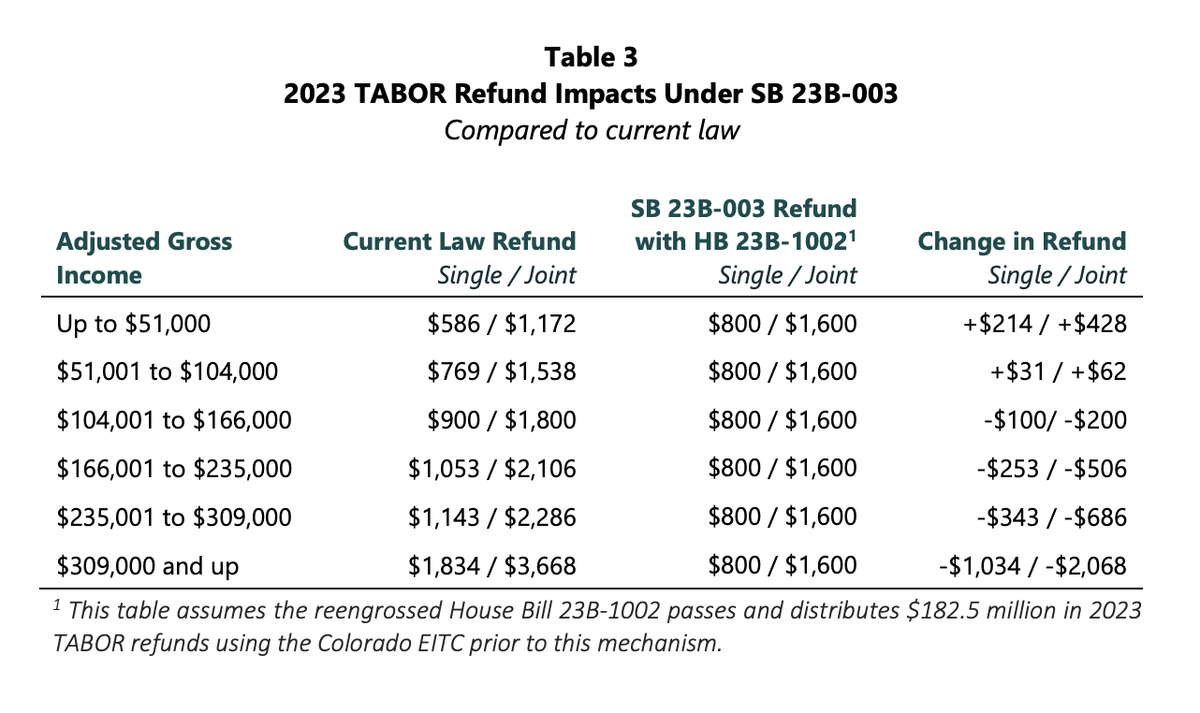

Under the current state law, the more money you make, the higher the TABOR refund you receive. However, this new bill would make the distribution more equitable by giving single filers $800 (the amount is doubled for joint filers).

If you make less than $104,000, you would receive more TABOR refund than you do right now. If you make more than $104,000, you would receive less of a TABOR refund.

Governor Jared Polis said he will sign the bills into law Monday night.