Ballot measure would tax firearm & ammo purchases in CO and fund crime victims services

COLORADO, USA (KRDO) -

A YES vote on Proposition KK would mean: a new tax on firearms, firearm parts, ammunition, and using the revenue for crime victim services, mental health services for veterans and youth, and school safety programs.

A NO vote would mean: the state’s taxation of firearms and ammunition will not change.

A new ballot measure in November would create a 6.5% excise tax on firearm-related purchases within the State of Colorado. The ballot measure, titled Proposition KK, is the result of a bill that was signed into law in May of 2024, but because it deals with taxes, it must be decided by the voters.

Proposition KK proposes amending the Colorado statutes to create a new state tax on firearms sellers equal to 6.5 percent of their sales of firearms, firearm parts, and ammunition, and exempts this money from the state’s revenue limit as a voter-approved revenue change; and using the new tax revenue to fund crime victim support services, mental health services for veterans and youth, and school safety programs.

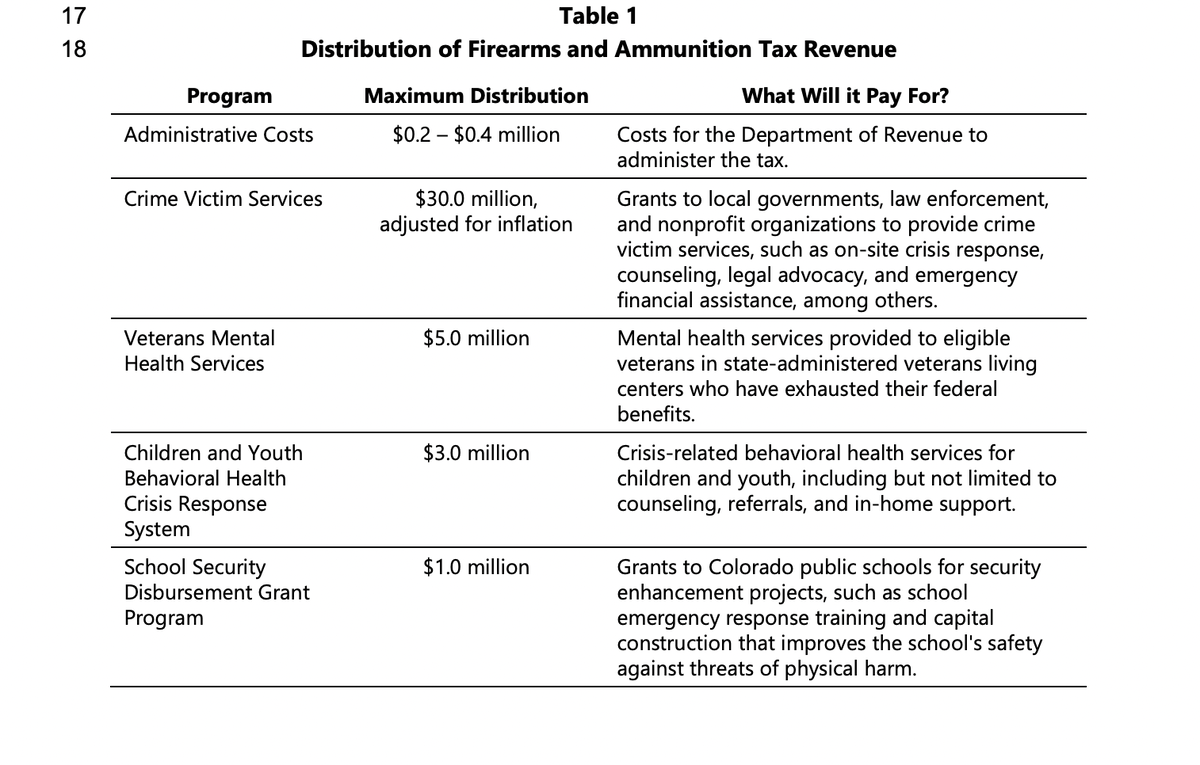

Below is a chart provided by the state legislature on how the state revenue would be dispersed amongst the aforementioned programs.

Firearm dealers, firearm manufacturers, and ammunition sellers are responsible for paying the new tax on their retail sales. Sellers with annual sales of less than $20,000 are exempt from the tax.

Retail sales to law enforcement officers, law enforcement agencies, and active duty military members are also exempt from the tax.

Private sales between individuals who are not firearm dealers, firearm manufacturers, or ammunition vendors are not subject to the new tax.

You can read the full breakdown of each draft of the proposition, along with the input given by stakeholders and both sides of those debating the ballot measure, here.