Historic increases in Colorado property values likely to result in significant property tax hikes in 2024

EL PASO AND PUEBLO COUNTIES, Colo. (KRDO) -- County assessors across the state are now seeing the effect of red-hot housing markets the past two years, and homeowners and other property owners will soon feel the financial pinch.

Assessors said that increases in property values -- specifically, for residential properties -- have reached heights never seen before in Colorado.

Median increases range from around 40% in El Paso and Pueblo counties, to between approximately 35% and 45% in metro Denver counties -- with increases in the ski resort towns even higher, from 40% to nearly 70%.

"With a lot of our vacant land in rural areas, we're looking at increases of 200%," said Pueblo County Assessor Frank Beltran. "I've been in the assessor's office since 1980 and I've never seen increases like this."

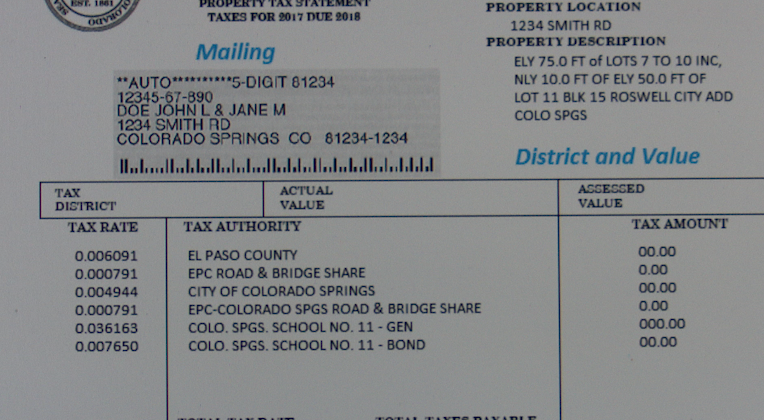

Eventually, that will mean higher taxes for many property owners when those bills begin going out in January 2024 -- but exactly how much higher is still being determined, because increased property values and tax rates aren't directly correlated.

The situation could force senior citizens and disabled veterans living on fixed incomes, to sell their homes; some experts said that the situation also will affect renters, as owners of apartment complexes pass along their higher property values.

"Cutting in half their actual property value at $200,000 really isn't enough," said El Paso County Assessor Mark Flutcher. "That was enacted 20 years ago. That value needs to be increased, and there was legislation to do that. However, that legislation and another proposal failed at the state capitol this year. There's another proposal to cap property taxes, but I don't know if it'll advance before the session ends next Friday."

Property owners who disagree with their increased value assessments can be asked to have them reviewed from May 1 through June 8, which is when assessors will officially notify those homeowners of their new values; a second appeal process starts after bills are mailed in January.

The higher values are determined on a two-year cycle; the most recent cycle was from July 2021 through June 2022 when Colorado -- particularly along the Front Range -- experienced record-high housing demand.

"If you want to appeal, call your realtors and ask them to help," said George Nehme, past president of the Pikes Peak Association of Realtors. "It's got a good success rate. It all depends on how you have your information in place. You have to provide the right information. They're pretty sharp at what they do. They have the information themselves of what's sold in your neighborhood, and what properties are equal to your property."

Nehme said that sometimes, mistakes filed with an assessor's office are made about the size of a home and whether it has had any upgrades by the owner.

Another factor in the final determination of property tax bills in January, is whether local taxing entities -- such as school districts and local governments -- raise or lower their millage rates during the remainder of 2023.

Assessors said that they hope the next reassessment cycle will provide lesser increases because the housing market has leveled off since the current cycle ended in the summer of 2022.