The Cost of Fertile Ground

PUEBLO COUNTY, Colo. (KRDO) -- Here at American Fertilizer Company, the outlook is grim.

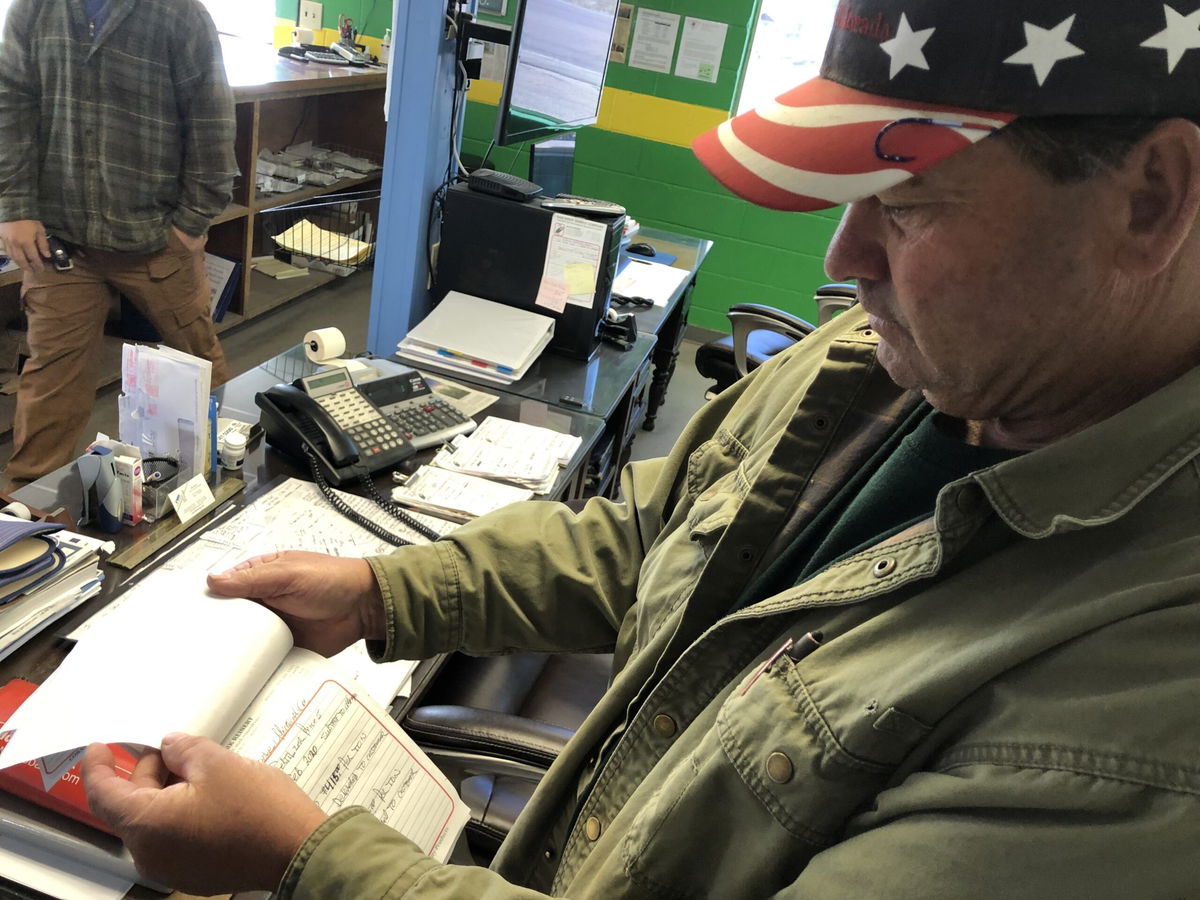

At the front desk, owner and operator, John Dionisio, keeps a hand-written log of the fertilizer costs through the years, on worn pieces of paper.

Pulling the taped sheets from his computer tower, he loops back two, three sheets.

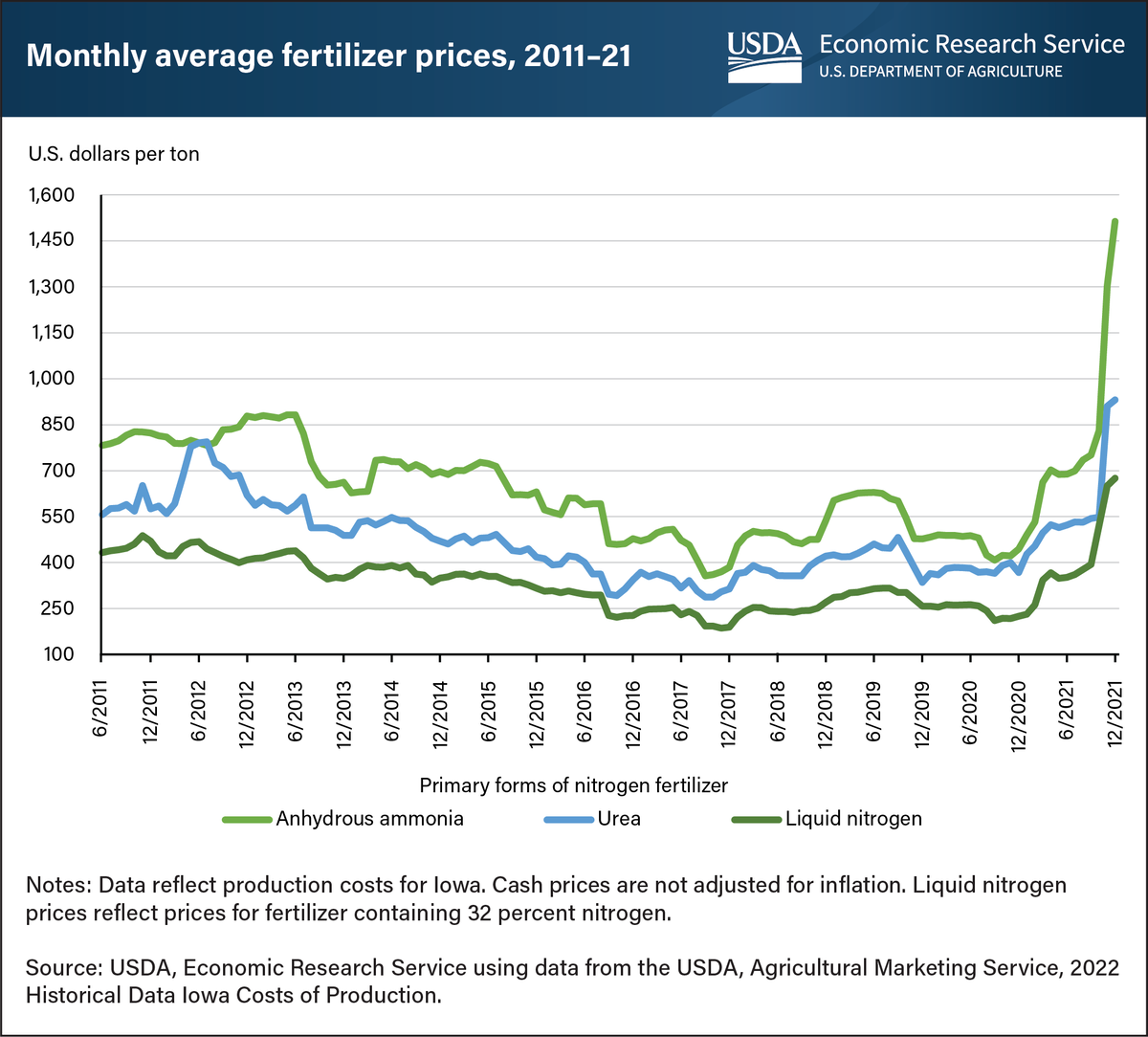

"There it is. In April 2020, the 32 [fertilizer] was $250 a ton," he says, then flipping forward one sheet, one year. "In April 2021, it was $422 a ton, and in 2022, it's $705 a ton."

The "32" refers to a liquid fertilizer, composed of ammonium nitrate, urea, and water.

It's a tripling - crippling - of fertilizer costs since 2020 that has farmers facing another tough year of production costs.

Those costs will, ultimately, be passed to consumers who have already been saddled with a 9% hike in grocery bills, from last year.

"It was a perfect storm of things going on in the world," laments Dionisio.

Between COVID lockdowns, a shortage of truck drivers, a spike in natural gas prices, and now unknowns with the largest exporter of fertilizers - Russia - Dionisio says the worst is yet to come.

Right now, the fertilizer supply is more expensive and slightly late; next year, the required fertilizer might not even be available, according to the businessman.

This year's costs are translating to a shift in strategy for Rusler Produce, on the Pueblo Mesa.

Ryan Froman, farm manager for Rusler Produce, says they are now planting less corn and more pinto beans -- which require less fertilizer. Rusler is also using more dry fertilizer, combined with manure, instead of liquid fertilizer, "strictly to try and save money," according to Froman.

Unlike direct-to-consumer farms, Froman earmarks a portion of Rusler's yield to the market, which means the farm alone will bear the brunt of rising costs -- despite corn prices being close to the highest they've ever been.

"We set a price before it's even grown, so it's hard to account for increase in costs," says Froman.

Why the increase?

KRDO took a look at what's contributing to the rising cost and increased strain on farmers here and across the state.

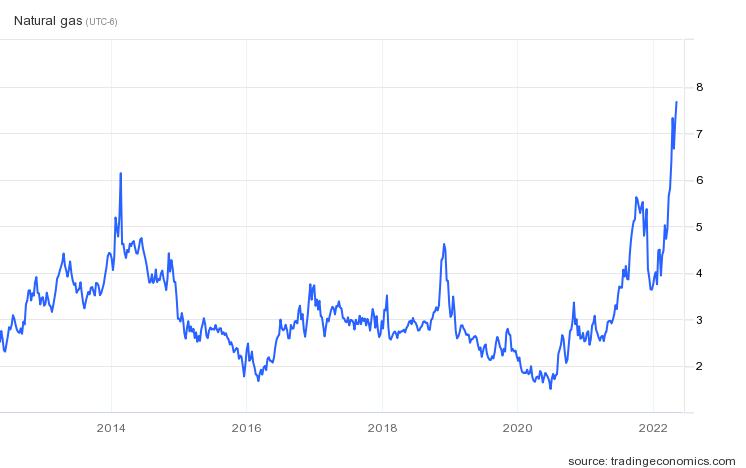

The natural gas factor

Natural gas prices are predictors of fertilizer prices, given that natural gas is used to produce nitrogen-based fertilizers; the trends mirror one another.

Demand for natural gas is predicted to grow amid a hot summer forecast in the Southwest, despite production for the commodity, but nearly stopping in 2020.

Russia's Invasion of Ukraine

Russia is the world's largest exporter of natural gas and fertilizer. That country's ban on nitrogen, phosphate, and potassium exports, in a retaliatory move to sanctions, has rattled global markets.

The U.S. traditionally imports 9% of its fertilizer from Russia, and won't be as affected as Brazil, which imports 21% of its fertilizer from Russia.

When will prices come down?

Some analysts predict that fertilizer prices will remain high through the coming winter months, if not beyond.

Given the volatility of the market, farmers are having to flex -- something they're used to -- with the changing market landscape.

"You never know what it's going to bring. Every year has its own challenges, whether it's water, fertilizer, mother nature through the growing season. Just try and manage the manage-ables, and do the best with what you have," says Nick Rusler, of Rusler Produce.