TABOR refunds are coming to Coloradoans in 2025. Here’s how much you can expect to receive

COLORADO SPRINGS, Colo. (KRDO) – Tax refunds are making their way into the hands of Colorado taxpayers again in 2025, thanks to TABOR, or the Taxpayer's Bill of Rights.

According to a recently released report from the Office of the State Auditor, the state of Colorado collected $1.4 billion more than it's allowed to keep under TABOR during the 2024 fiscal year. That money will be refunded, along with an additional $289 million that was previously under-refunded.

TABOR, which was approved by voters in 1992, puts a cap on the amount of tax revenue the state can keep every year. If there's excess revenue collected, the state is required to refund it to its taxpayers.

Those refunds are expected to be paid out next year, with the amount varying taxpayer to taxpayer based on gross income.

Here's how next year's refunds look, based on income level:

| Adjusted Gross Income | Single filers | Joint filers |

| $53,000 and below | $181 | $362 |

| $53,000 and below | $241 | $482 |

| $107,001 to $172,000 | $277 | $554 |

| $172,001 to $243,000 | $330 | $660 |

| $243,001 to $320,000 | $355 | $710 |

| $320,001 and above | $571 | $1,142 |

Thanks to a new law from Gov. Polis regarding TABOR refund mechanisms, Coloradoans will also see a temporary reduction in their income tax rate from the current 4.40% to 4.25% in 2024.

But it's not all good news.

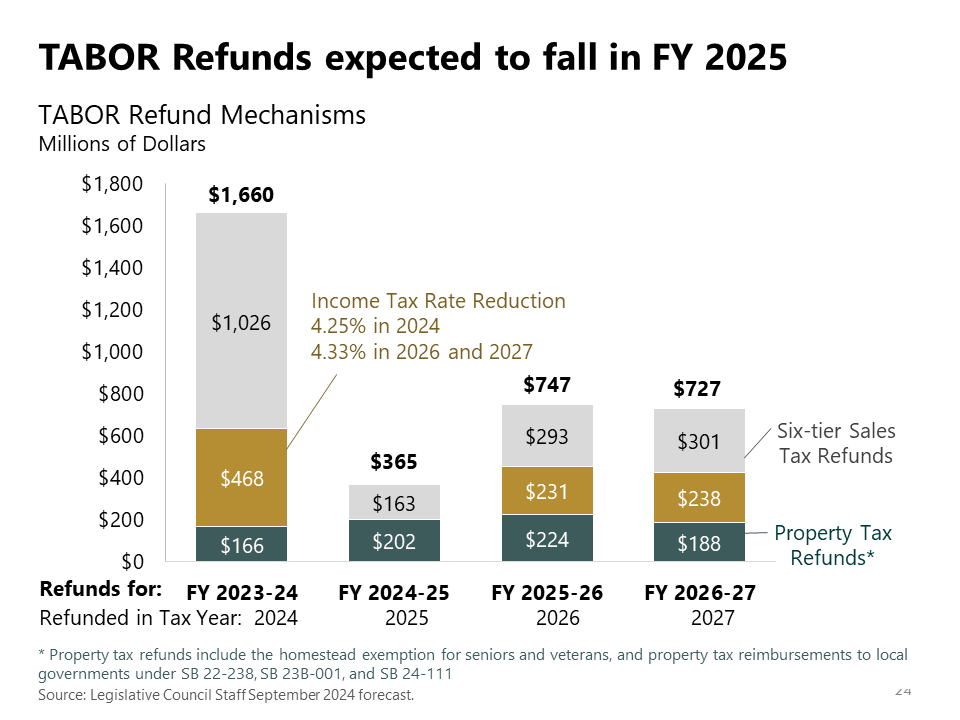

Refunds are expected to happen through at least 2027, but the surplus is expected to drop significantly in the coming years – meaning a smaller TABOR refund.

According to the Colorado Legislative Council Staff, TABOR refunds are expected to fall from a total of $1.66 billion in fiscal year 2023-24 to $365 million for fiscal year 2024-25.