Governor Polis calls the IRS proposal to tax TABOR refunds “absurd”

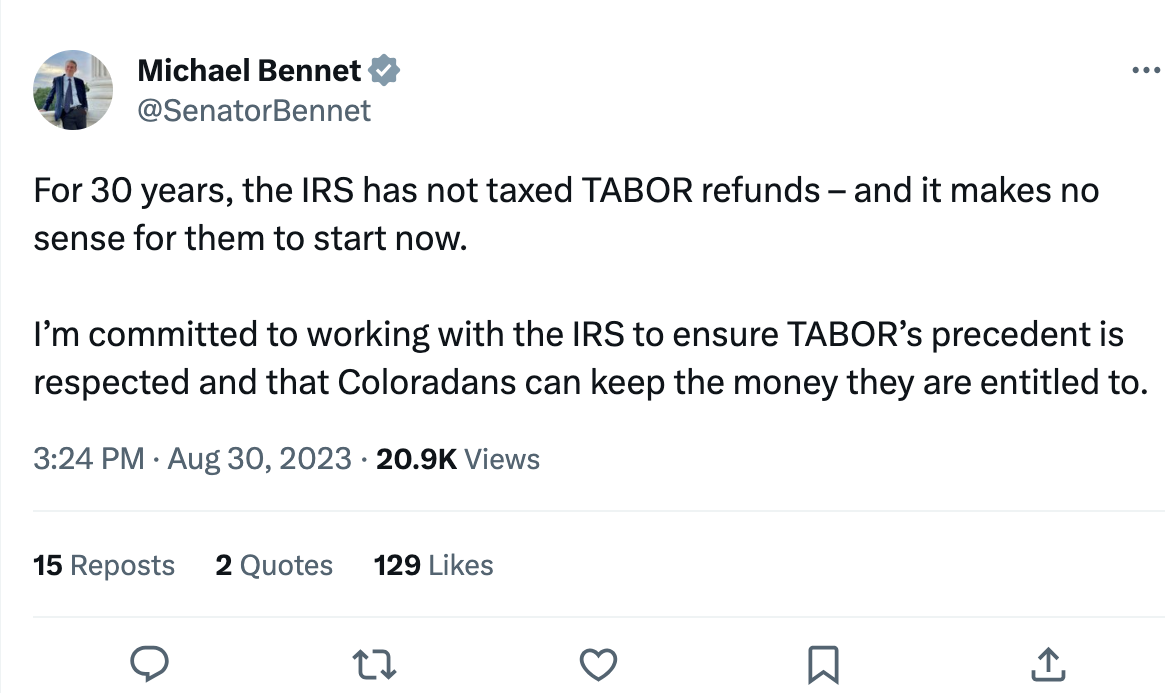

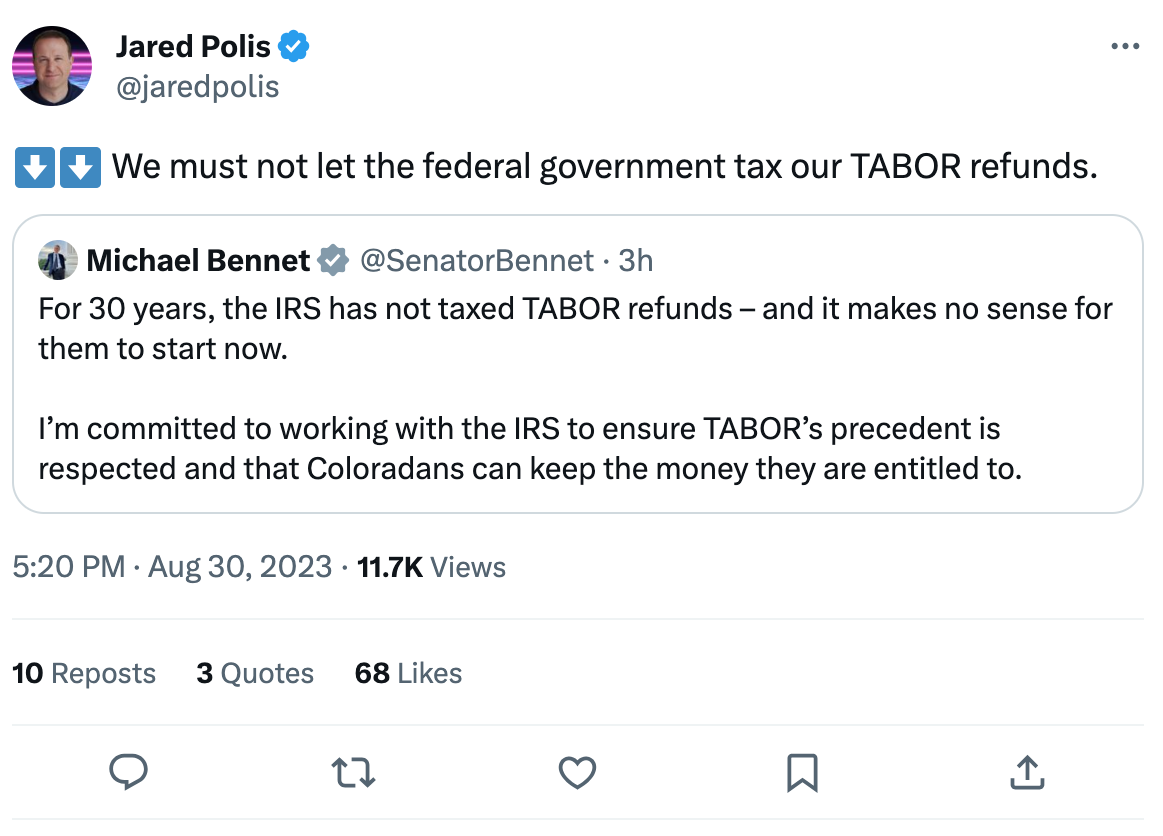

COLORADO SPRINGS, Colo. (KRDO) - Colorado Governor Jared Polis as well as U.S Senator Micheal Bennet spoke out on Twitter Wednesday after the Internal Revenue Service (IRS) released its proposal to potentially tax TABOR refunds in the next tax cycle.

Polis called the idea "absurd". In an interview with KRDO, he said it does not make any sense.

"There's no way that it makes sense for this to be subject to any kind of income tax itself. I'm really hopeful to prevail at the end of the day. But frankly, it's scary. It even got this far because it defies common sense," Polis said.

The Taxpayer's Bill of Rights (TABOR) Amendment was approved by voters in 1992. This amendment limits the amount of revenue governments in the state can retain and spend, according to the Colorado Department of Revenue. The excess revenue is then required to be refunded to taxpayers.

Back in February, the IRS decided to not tax Colorado TABOR payments from 2022. The department said that while in general, payments made by states are counted in income for federal tax purposes, there are also expectations that apply to many of the payments made by states in 2022. That exception includes TABOR payments.

As of Wednesday, the IRS is considering taxing these state refund programs like TABOR. However, the IRS made it clear in its proposal that the refund would only be taxed for individuals who itemized deductions and deducted for federal income tax purposes. But, they stated this is the minority of tax filers. The IRS states in the proposal that most people claim the standard deduction and that will not include state tax refunds in federal gross income.

"We think that this would cause about 10% or so of Colorado taxpayers to have to pay income tax on their TABOR refund. But that should be zero. Nobody should pay tax on a refund from a tax. Doesn't make any sense. I think what it's getting conflated with is some states have sent stimulus or checks to people arguably that may be subject to taxation," Governor Polis said.

KRDO requested an interview with the IRS. They were not available, but they did leave us this statement below:

"The notice requests comments regarding the application of the rules described in the notice, as well as specific aspects of state payment programs or additional situations on which federal income tax guidance would be helpful." "So things are subject to potential change." "I promise to keep an eye out and ensure you get any future updates on this topic."

-Karen Connelly

Chief, IRS Media Relations

The IRS said in its proposal that they're accepting comments in writing on or before October 16, 2023.