Seniors missing out on TABOR rebate checks

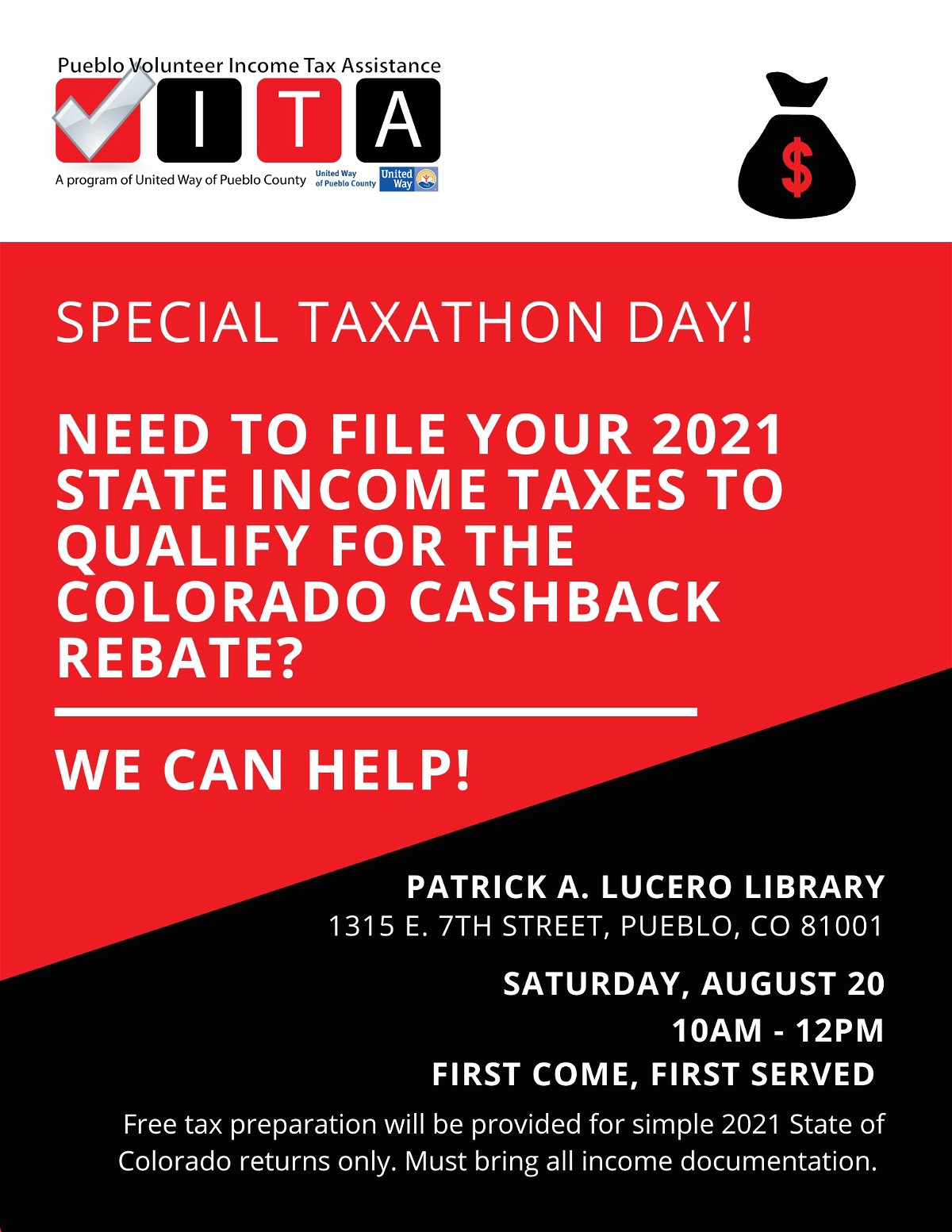

PUEBLO, Colo. (KRDO)-- United Way of Pueblo County is holding a taxathon event on Saturday, August 20th from 10 a.m.- 12 p.m. at the Lucero Library.

The Pueblo Volunteer Income Tax Assistance (VITA) Program provides free tax preparation and e-filing services to individuals and families with household incomes of $55,000 or less. According to the Vice President of Strategic Operations at United Way of Pueblo County, they have more than 5 IRS-Certified volunteers that will help anyone file to get their TABOR rebate checks.

While the date to file for state taxes has passed, it's not too late to file to get your check. Officials at United Way of Pueblo County said taxpayers have until October 17 to qualify. No appointments are necessary, individuals will be served on a first-come, first-served basis.

"I think any time you say the word taxes or tax rebate or stimulus or anything like that, it's confusing. I have learned more about taxes in the last year than I ever thought I would in my role here at United Way. But I think it's just not very clear, and it's something that we don't deal with on a day-to-day basis, said Bianca Hicks, The Vice President, Strategic Operations at United Way of Pueblo County.

Hicks said she hopes to see a lot of seniors at the event. She said many are missing out on the TABOR rebate check. According to the Colorado Department of Revenue, Seniors who just rely on social security don't have to file for State income tax, meaning they will not receive the Tabor rebate check. Meghan Tanis, the Director of Communications with the Department of Revenue, said seniors should file for state taxes even if they have no additional income because they will receive the $750 check.

"It's potentially life-changing. It might make up that shortfall of that month, whether it be helping to go towards rent or gas, as we've all experienced the prices of everything going through the roof. So those additional dollars from the state and also federally through taxes, that return really does make a big difference for individuals and families in our community," said Hicks.

Hick's said the TABOR Rebate checks are not the only credits many people are missing on. According to the Colorado Department of Public Health (CDPHE), 1 and 4 Coloradans miss out on the Earned Income Tax Credit (EITC). The CDPHE said, the EITC helps individuals and families living on low incomes break out of generational poverty. Also, more than 92% of Colorado families with children are eligible for the Child Tax Credit.

"We get the best, like smiles and hugs and thank you's from folks that come and see our vital volunteers. I mean, taxes are extremely stressful," said Bianca Hicks

While this event this Saturday, is to only help with TABOR rebate checks, Hicks said they're always willing to help families apply for an amendment to get these credits for this year. She said these two credits plus the rebate are the tax credits Coloradans are missing out on.

"We do offer multiple tax sites throughout the Pueblo community that helps ensure that folks are getting the tax credits that they qualify for. So that's going to be the earned income tax credit, the child tax credit," said Hicks.