“Decks R Us” owner files for bankruptcy; victim list grows

Contractor Kevin McGee, the owner of Colorado Springs contracting company 'Decks R Us' filed for Chapter 7 bankruptcy following accusations that he and his colleagues stole $162K from nearly a half-dozen families.

McGee has been the focus of a five-month KRDO investigation that we first broke in July. The initial tip began with five families who all shared similar stories.

Each family said they paid Kevin McGee or his counterpart Ken Peterson to construct a new deck, but after the check was delivered the two vanished. In nearly each case, little to no work was completed.

The company advertised online as "established and proven". It claimed to "treat each and every customer how they'd expect to be treated."

"You feel violated. How dare you?" said Charlene Keating, who paid McGee $6,000 for a deck on her home.

"They straight up lied to me," said Mia Jennings, another victim who paid McGee $35,000.

"Just awful, I can't believe it happened," said Michael Clabough, who paid McGee $31,000.

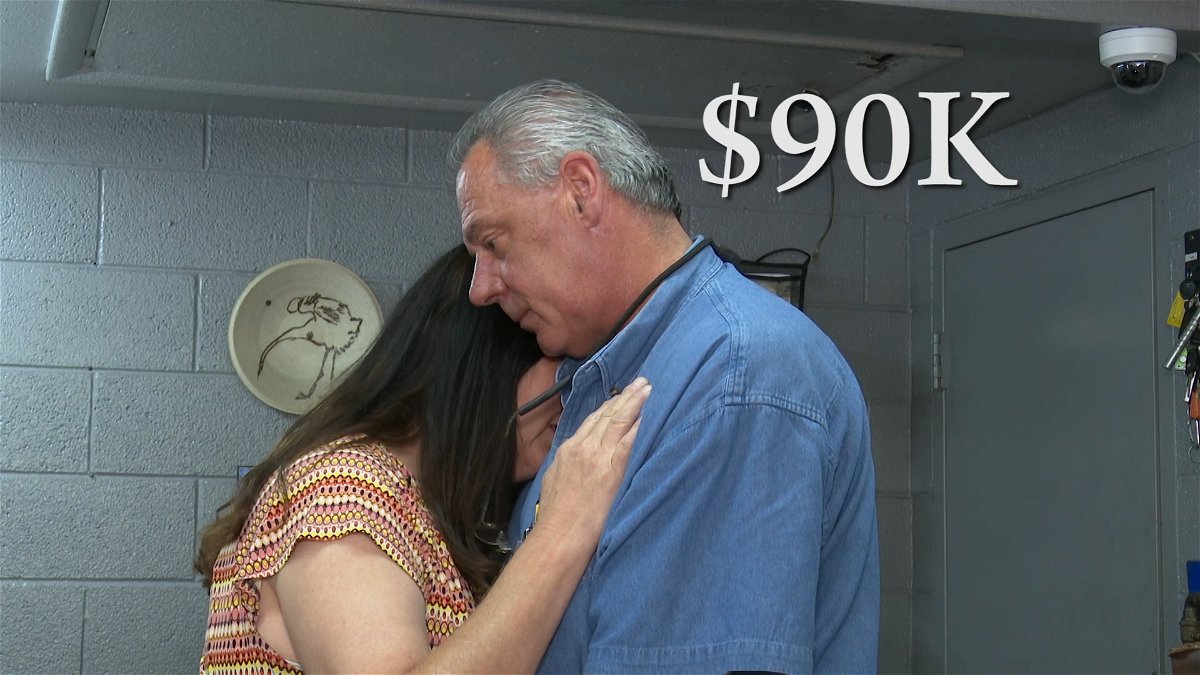

But the highest losses ended with Charles and JoAnn Lawson.

"It's been a nightmare," said the Lawsons. They paid McGee a whopping $93,000 over the course of several down payments for materials and labor.

But McGee vanished. The Lawson's deck was never completed.

KRDO reporter Stephanie Sierra questioned McGee back in July over the phone.

"Are you telling me that you've done all the work that they've paid you for?" asked Sierra.

"Yes," McGee said.

A week later Sierra had a scheduled interview with McGee, but he failed to show up. Instead, she ended up speaking with his partner Ken Peterson of Majestic Outdoor Environments.

"Do you think these people are being treated fairly?" asked Sierra.

"Yes, I think they're being treated the best they can be... yeah," Peterson said.

Despite promises, none of the work was finished for these five families.

"Something has to be done with these guys," said Charles Lawson, who later filed a civil lawsuit against McGee just days before he filed for bankruptcy.

Our team again tried to get McGee's side. First by calling and then eventually by showing up at the address that was listed on the bankruptcy papers.

Sierra was only able to ask one question before McGee slammed the door.

"Where is the money? Where is it?" Sierra asked.

"Talk to my lawyer," Mcgee said before slamming the door.

A total of $162,000 has seemingly vanished.

Meanwhile, the victim list continued to grow. Our team heard from another four families since our series started, bringing the total victim count to 9 families.

Each family reported that they've lost money from the company and were left without a finished product.

We brought the case to David Kobba, who specializes in bankruptcy law.

"That's what the debtor [McGee] wants, is that discharge order. That means the creditors are not collecting [his] debts," said Kobba.

That discharge order is what the victims in this case are worried about.

"[The victims] can obtain an order of non-discharge ability as their particular debt, because their fraud qualifies for this order," said Kobba.

Kobba says it's likely that the victims in this case will receive a restitution order which will likely require McGee to work and pay off debt as a condition of his probation.

McGee is facing both criminal and civil charges in two separate lawsuits. He's due back in court on Dec. 16.