Wildfire mitigation fee for certain homeowners discussed Monday in Colorado Springs

COLORADO SPRINGS, Colo. (KRDO) -- If you live in an area having a high danger of wildfires, would you pay an annual tax to help finance increased fire prevention? And if so, how much?

Those are questions many Colorado Springs homeowners will consider in the coming months, as the City Council and Fire Department discuss the idea of a wildfire mitigation tax.

Such a tax is something that surrounding states already have, according to Council President Richard Skorman.

"We don't have one even though we have a higher wildfire risk and danger of property loss than any Western state except California," he said.

Colorado doesn't have such a tax because state law doesn't allow the creation of a special district for that purpose, Skorman said, but that could change soon.

"The state Legislature is putting together regulations right now, that we may be able to take advantage of -- that would make creating a special district easier," he said. "If that's the case, then we may want to go out to the voters, maybe as soon as next November, to see if they'll be willing to tax themselves and allow us to be more proactive."

Although the amount of such a tax has yet to be determined, Skorman said that around $40 to $50 seems the right amount.

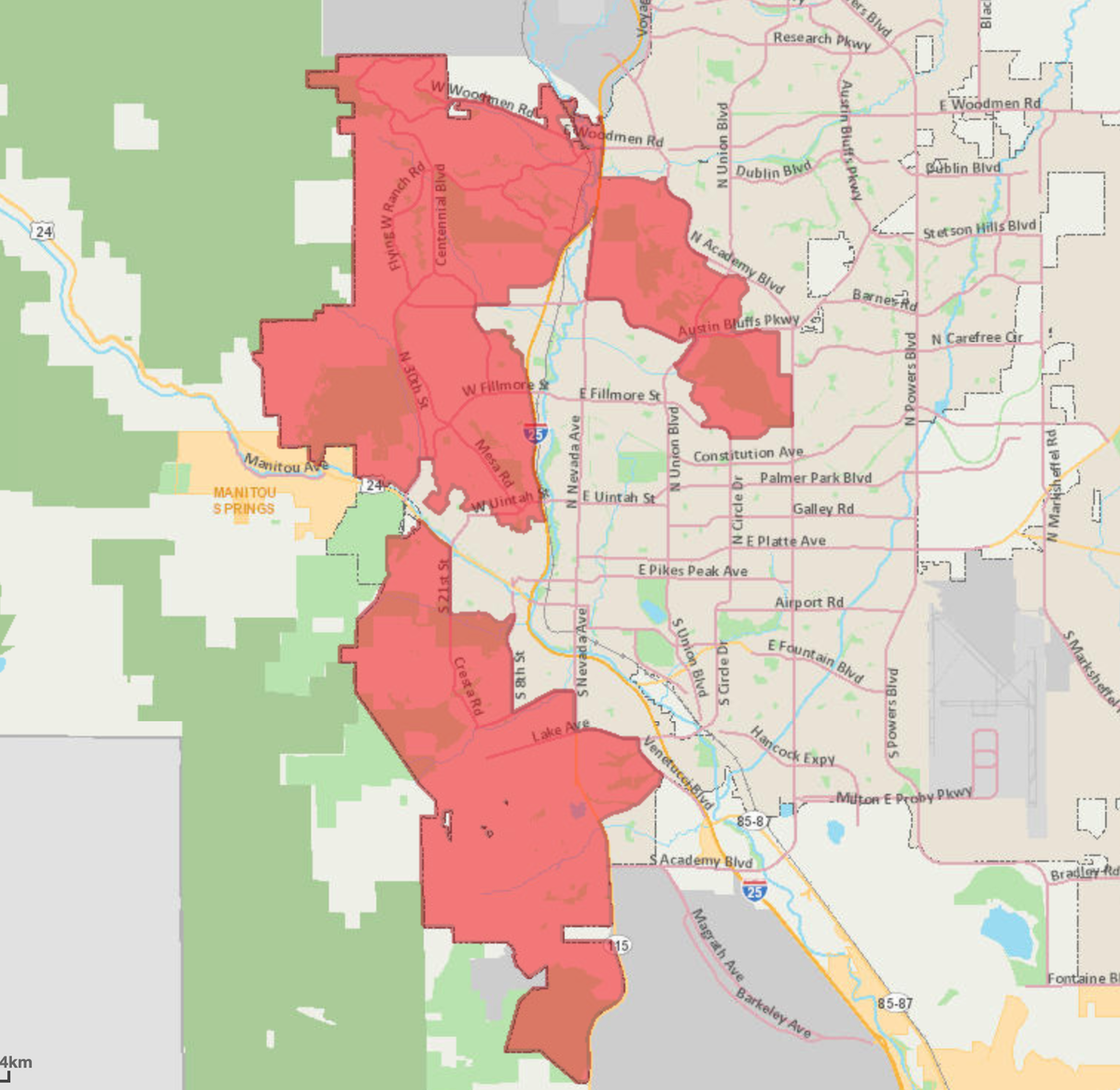

It would be paid by homeowners living within the Wildland Urban Interface, an area primarily west of Interstate 25 in the city limits, which includes thousands of homes in or near zones at highest risk of wildfires.

"It also includes areas such as Palmer Park," Skorman said.

Previous mitigation, or fire prevention, was hailed as a major factor in reducing damage from the recent Bear Creek fire and Skorman, along with Fire Marshal Brett Lacey, say that increasing the degree and frequency of mitigation can save the city money in property losses from future fires.

"I would think as far as the magnitude of money, we would be vastly improved if we got somewhere on the order of between $1 million and $2 million (annually), tops," Lacey said. "But that money's got to be examined, looked at and figured out. Additional funding would be a big help because City Forestry does some wildfire mitigation but also is responsible for the city's entire tree inventory."

Along with removing potential fire fuels, a fee also could allow the Fire Department to offer chipping programs more often, in which homeowners do their own mitigation and place material on curbs or sidewalks for crews to remove.

"We could offer chipping in neighborhoods two times a month instead of two times a year," Skorman said. "And I think we could cover more ground because we could motivate private businesses to mitigate around their properties."

Having more money for more resources could have prevented -- or lessened the severity of -- the 2012 Waldo Canyon Fire and the 2013 Black Forest Fire. he said.

"Remember, the Waldo Canyon Fire burned for 24 hours before it flared up past the point where anyone could control it," he said.

Skorman said if a fee is approved, he'd like some of the revenue to improve the speed and safety of wildfire evacuations.

"Everything worked well in the Bear Creek Fire," he said. "People could evacuate and firefighters could get in quickly. But it may have been a different story if the wind had been blowing stronger or in a different direction. Trying to evacuate people then, on narrow streets and roads, would be daunting."