Behind the Ballot: Proposition HH more ‘complex’ than just reductions to property taxes, TABOR refunds

COLORADO SPRINGS, Colo. (KRDO) -- In simplest terms, Proposition HH, a ballot initiative in the November election, would reduce property taxes, increase the state’s Taxpayer Bill of Rights (TABOR) cap, allowing the state to retain more revenue and in turn reduce TABOR refund amounts to citizens. But the proposed legislation is much more complex than that.

As property values across the state skyrocketed, some by more than 35%, Colorado legislators came up with a solution to limit the financial impact on citizen’s pocketbooks through property taxes.

“State legislators and the Governor's Office have heard from constituents, ‘We're concerned about rising property tax bills,’” said Greg Sobetski, the chief economist with the Colorado Legislative Council. “The state has chosen to step in with this proposal and ask voters, ‘Should we reduce state assessments?’”

Senate Bill 23-303 would reduce property taxes by lowering the valuation for the assessment of certain residential and nonresidential properties. However, this bill is contingent on Proposition HH passing in November because the state needs to be able to increase its revenue to make up for the loss in revenue by local entities due to the decreased property taxes.

If you vote ‘yes’ on Proposition HH, it will lower property taxes owed, allow the state to keep additional money that would otherwise be refunded to taxpayers, temporarily change how taxpayer TABOR refunds are distributed and create a new property tax limit for most local governments.

If you vote ‘no’ on Proposition HH, it will maintain the current law for property taxes, TABOR refunds and state and local government revenue limits.

The Taxpayer’s Bill of Rights (TABOR) limits the amount of money the state government can collect and spend or save each year. Any money collected above the limit is refunded to taxpayers.

If passed, Proposition HH would increase that TABOR cap each year. In 10 years, the state would be able to retain $2.2 billion more in revenue than it would under the current TABOR cap. The proposition would also allow the state legislature to retain revenue after 2032 without voter approval.

“All of that is more state revenue that can be retained and smaller TABOR refunds to taxpayers when revenue would exceed the limit,” Sobetski said.

For 2023 only, Proposition HH would distribute refunds in equal amounts to each taxpayer, estimated at $898 for single filers and $1,796 for joint filers. The following years TABOR refunds will decrease, with the amount depending on your adjusted gross income. Citizens with a larger income ($230,000) will see higher decreases, about $100 to $200, than those with a lower income ($75,000), about $40 to $90.

“Every voter's circumstances are different and because those circumstances are going to change every time and because they're going to change in different ways for different people, we can't categorically say Prop HH will save you this much money over this time period, or Prop HH reduces your TABOR refunds by this much money over this time period,” Sobetski said.

The state will then use this retained revenue for three purposes:

- Up to 20% will be reimbursed to local governments for lost property tax revenue.

- Up to $20 million will be used each year for rental assistance.

- The remaining funds will be used to reimburse school districts for reduced property tax revenue.

Despite reimbursements from the state to local governments for lost property tax revenue, Sobetski predicts Prop HH to decrease revenue to local governments statewide by at least a total of $240 million in 2024, $510 million in 2025, and $650 million in 2026.

“For other local governments that aren't school districts, so for counties, municipalities and special districts, there is a revenue loss because there's less property taxes paid and the state isn't going to make up 100% of that difference,” Sobetski said.

The City of Colorado Springs said the decrease in revenue will in turn affect the amount of the city’s TABOR refund they provide to residents on their property tax bill.

“If the total revenue coming in declines, then it will reduce the amount of credit provided on the property tax bill to the property taxpayers in the city,” said Charae McDaniel, the chief financial officer for Colorado Springs.

Dave Dazlich, the vice president for government affairs with the Colorado Springs Chamber & EDC, said Proposition HH is a sweeping solution to reduce property taxes and is really “disguised” as a public education spending and budget bill.

“This is about expanding the general fund, the state budget, and reworking the public education funding formula,” Dazlich said.

Proposition HH will significantly increase funding to the State Education Fund and public schools, including $360 million in the state budget by 2025.

Dazlich said the Chamber doesn’t support Prop HH because of “long-term structural instability in the state’s budget.” He’s worried increasing spending by $2.2 billion in the next ten years could negatively affect the business community if the economy declines.

“If we hit any sort of economic downturn or even a slowing of the economy, if we don't manage to keep up with the economic growth of the late teens and early 2020s, then we could have ourselves a budget shortfall that's going to have to be made up from somewhere, most likely on the backs of Colorado businesses,” Dazlich said.

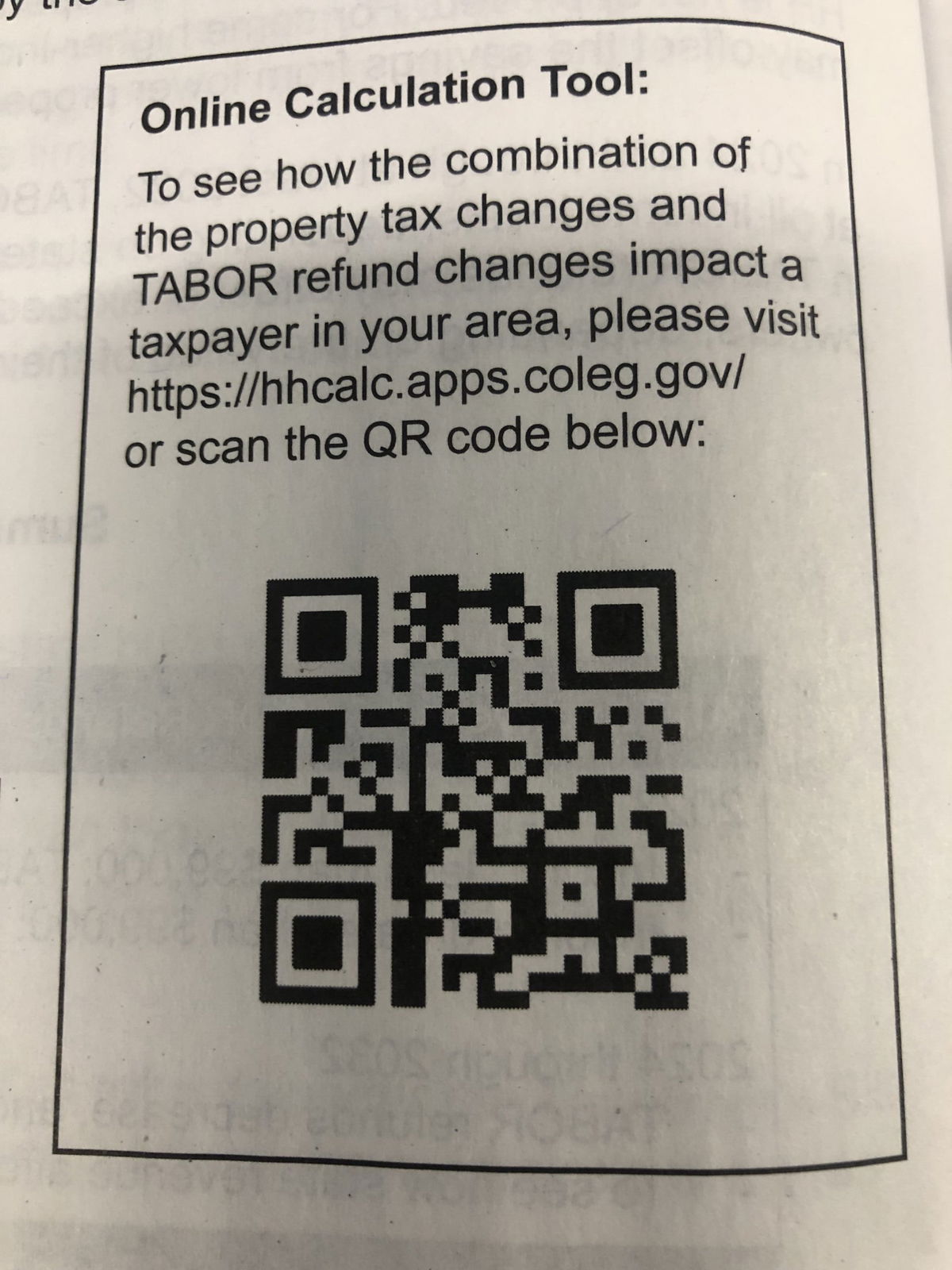

As for the direct impact on taxpayers, it comes down to a simple question — will the reduction in property taxes outweigh the likely decrease in TABOR refunds? Sobetski said it depends on the taxpayer’s circumstances, including where you live, how much your home is worth, and how much income you earn. This QR code will help determine how Prop HH will personally affect you in 2023 and 2024.

“It is true for most taxpayers in the short term that your property tax savings will exceed your additional taxes owed or your smaller TABOR refund amount,” Sobetski said. “Further out you look though, the property tax benefit tends to be more stable over time, whereas the TABOR impact becomes larger over time.”

However, Sobetski said it’s not that simple and more complicated to predict. He said many factors will determine how Proposition HH affects taxpayers, businesses, local governments, and schools long term, including the economy, inflation, the housing market, and population growth.

“This is going to impact different people different ways,” he said. “The impacts are different enough that they're difficult to generalize.”