Millions in funding for schools, fire districts will be stripped if Gallagher Amendment remains

COLORADO SPRINGS, Colo. (KRDO) -- Millions of dollars of tax revenue are in jeopardy for southern Colorado. The money is incredibly important as it relates to our schools, emergency response times and critical road projects.

The potential millions in funding loss are related to a Colorado tax law called the Gallagher Amendment. An effort is underway at the state capitol to repeal the amendment in hopes of avoiding potentially catastrophic budget cuts, but ultimately it will be voters who make the decision.

The Gallagher Amendment, if it remains in place, will lower residential property taxes in 2022, following property assessments in 2021. It's welcome news for Colorado homeowners who have lost income from the COVID-19 pandemic.

For schools, counties and small fire departments who rely heavily on property taxes, it means significantly less money for them while already faced with budget cuts because of the pandemic's impact on the state education budget and sales tax.

Coloradans voted to change the way homes were appraised back in 1982. The Gallagher Amendment ensures property taxes on homes would always be less than the rate on businesses. The Gallagher Amendment requires that homeowners pay 45% of the state's property tax revenue, and commercial property owners pay the remaining 55%.

The loss of income due to COVID-19 means commercial properties will soon be valued much lower. That will have a ripple effect because the state law will also force the lowering of the assessed value of residential properties to maintain the 55-45 ratio Gallagher requirement.

Colorado homeowners currently pay taxes on 7.15% of their assessed property value. If the Gallagher Amendment stays on the books, homeowners would only pay taxes on 5.88% of their assessed value in 2022. That equates to around an 18% cut on property taxes for homeowners.

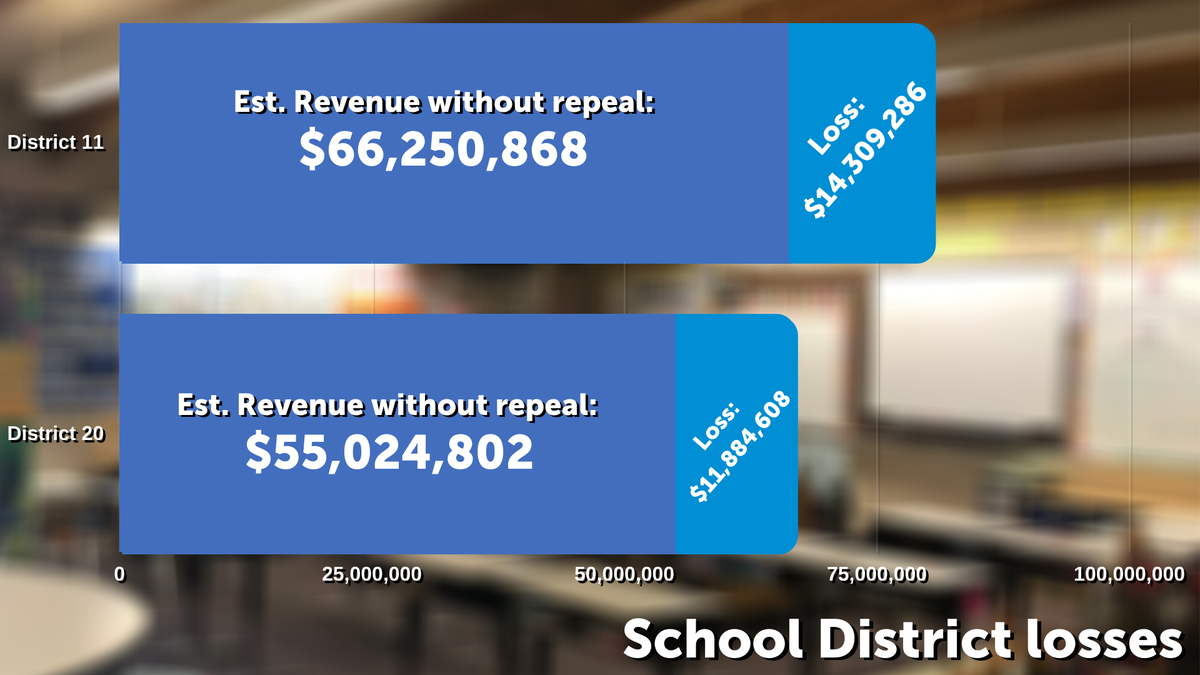

The impact in El Paso County could be significant if the law continues to be in effect. The El Paso County Tax Assessor's office predicts more than $61 million is at stake for local municipalities, school districts and first responders.

El Paso County could potentially lose more than $7.5 million in property tax revenue. The projected loss is more than 17% for the county.

Fire districts like Black Forest, Peyton or Hanover, which rely more on property tax revenue than other entities, face up to 18% in revenue loss.

As much as $14 million in cuts could come for individual school districts in the Colorado Springs area. The projections indicate as much as an 18% loss for school districts in El Paso County.

The group of state lawmakers pushing for the repeal of the Gallagher Amendment stress that if voters were to approve getting rid of the law, it wouldn't increase property taxes for homeowners. Colorado's current law requires voter approval for tax increases.

Those who oppose repealing the law believe it could lead to other loopholes and tax increases in the future.