Long-awaited transportation bill passed by state lawmakers, awaits governor’s signature

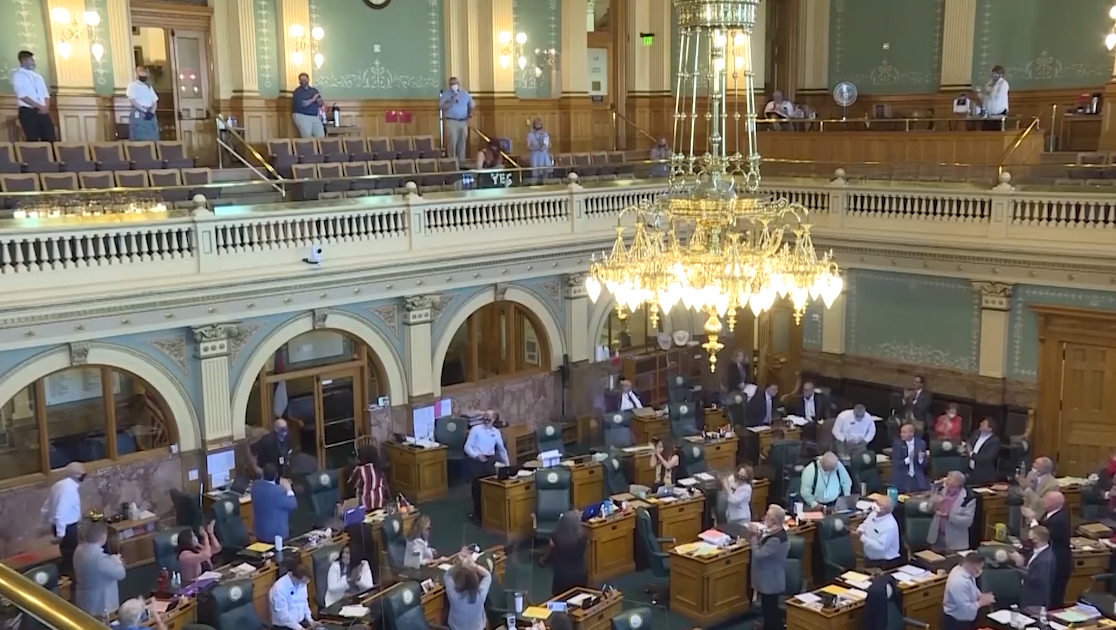

COLORADO SPRINGS, Colo. (KRDO) -- After many previous failed attempts and disagreements at the state capitol in Denver, the Legislature has passed a $5.4 billion transportation funding bill near the end of the current session.

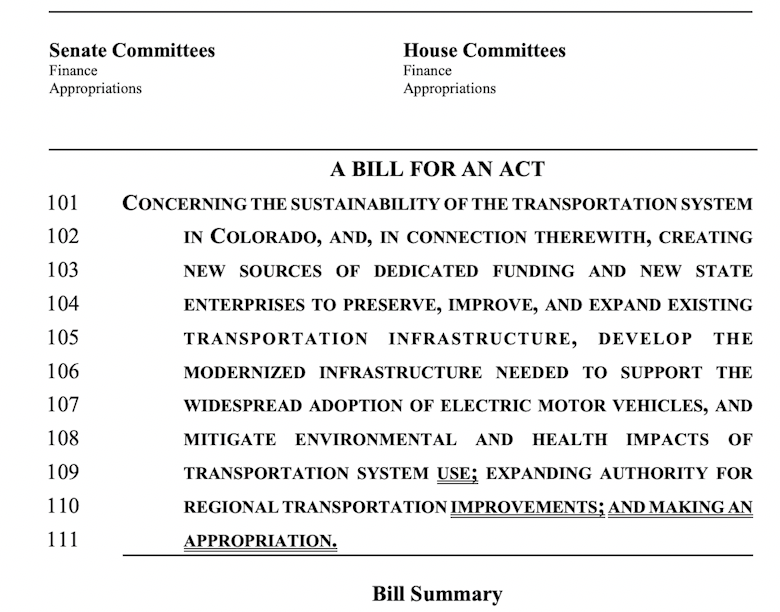

Senate Bill 260, "Sustainability of the Transportation System," was passed Wednesday by the House, following earlier passage by the Senate. The bill becomes effective after Gov. Jared Polis signs it, which could happen as early as next week.

Instead of using tax increases, the bill relies on user fees to generate $3.8 billion of the bill's amount. The rest will come from the state budget and federal stimulus funding.

The bill's main facet will add two cents per gallon to gasoline and diesel fuel purchases starting this year, and raise the fee to eight cents by 2028. The current per-gallon state gas tax is 22 cents.

A 27-cent fee on deliveries -- such as Amazon packages and restaurant drop-offs -- as well trips on Uber and other ride-sharing services, are part of the bill.

There also will be unspecified higher fees required for registering electric and hybrid vehicles, to offset the lower gas tax revenue generated from those owners.

However, the bill does provide citizens with a two-year decrease in vehicle registration fees; by $11 next year and $5.50 in 2023.

The revenue generated would be allocated to highway construction and repair, as well as expanding public transit and electric vehicle infrastructure.

Of the total funding, $2 billion would pay for new projects; $950 million would be given to local governments; $855 million would help pay off past transportation debt; $734 million would be dedicated to electric vehicle fleet conversions and new charging stations; and $453 million would go to mass transit, bike lanes and other driving alternatives.

The Colorado Department of Transportation's "Revitalizing Main Streets" program, featured on a KRDO NewsChannel 13 report earlier this week, would receive $115 million from the transportation bill.

The bill passed along party lines in the Democratic-controlled Legislature, despite strong opposition from many Republicans.

Critics, including Rep. Andy Pico, D-Colorado Springs, said that the bill includes no voter feedback, and that the fees generally are the same as taxes.

But Rep. Tony Exum, Sr., chairman of the House Transportation Committee, disagrees.

"Citizens have voted down tax increases for transportation plans several times," he said. "The message we got from that, is they voted us into office to solve the problem. That's what we're doing."

The bill is described as the largest and most detailed transportation funding bill in state history.

Some opponents are already considering the possibility of legal challenges and even a ballot measure to reduce the state gas tax.

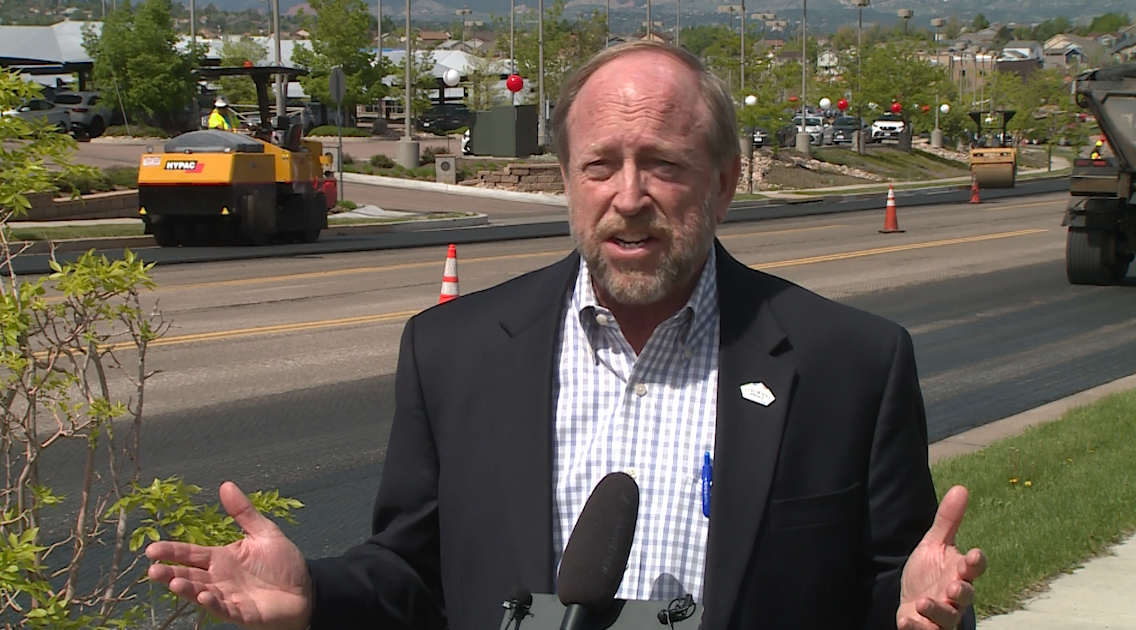

But the bill could mean an additional $7 million for the Pikes Peak region, said Colorado Springs Mayor John Suthers.

"We can use it for our local highways and our city streets," he said.