Colorado ranked 6th-highest state for increased credit card usage in light of inflation

COLORADO, USA (KRDO) – A new report that looks at the recent impact of inflation on credit card reliance in the U.S. reveals out of all states, Colorado experienced the sixth-highest rate of increased credit card reliance due to inflation.

The report comes from Upgraded Points and it found that 40.8% of adults in Colorado relied on credit cards to meet their spending needs and 23.4% have increased their credit card users due to recent price increases.

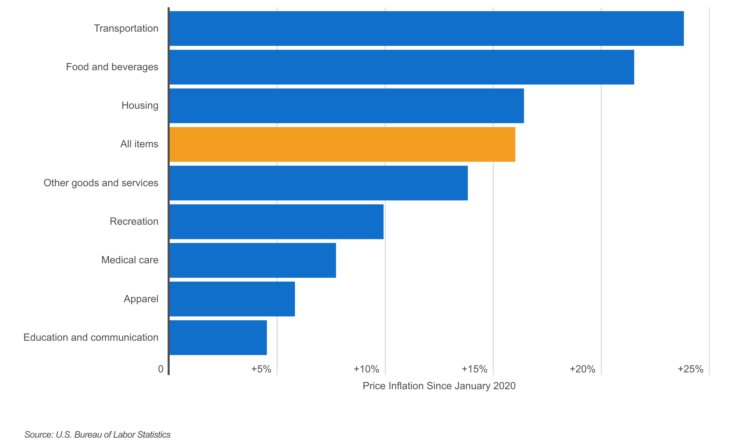

According to the analysis, the spending categories with the greatest price increases are necessities including transportation, food, and housing.

The report shows all categories experienced a 16% price increase and found that these are the toughest for households to cut back on.

Upgraded Points cites inflation has pushed 21% of adults to use credit cards, loans, or pawnshops to help pay for the increased costs.

The report shows while states in the Midwest have the fewest adults reporting an increased reliance on credit cards, nearly 1 in 4 adults in the Western states are using their cards more often to cope with inflation.

For more information about the original report, visit the Upgraded Points website here.