Financial assistance coming slowly for struggling small businesses in Colorado Springs area

EL PASO COUNTY, Colo. (KRDO) -- Some local small business owners said they are waiting weeks, even months, to get federal money for pandemic recovery or learn if they qualify for it.

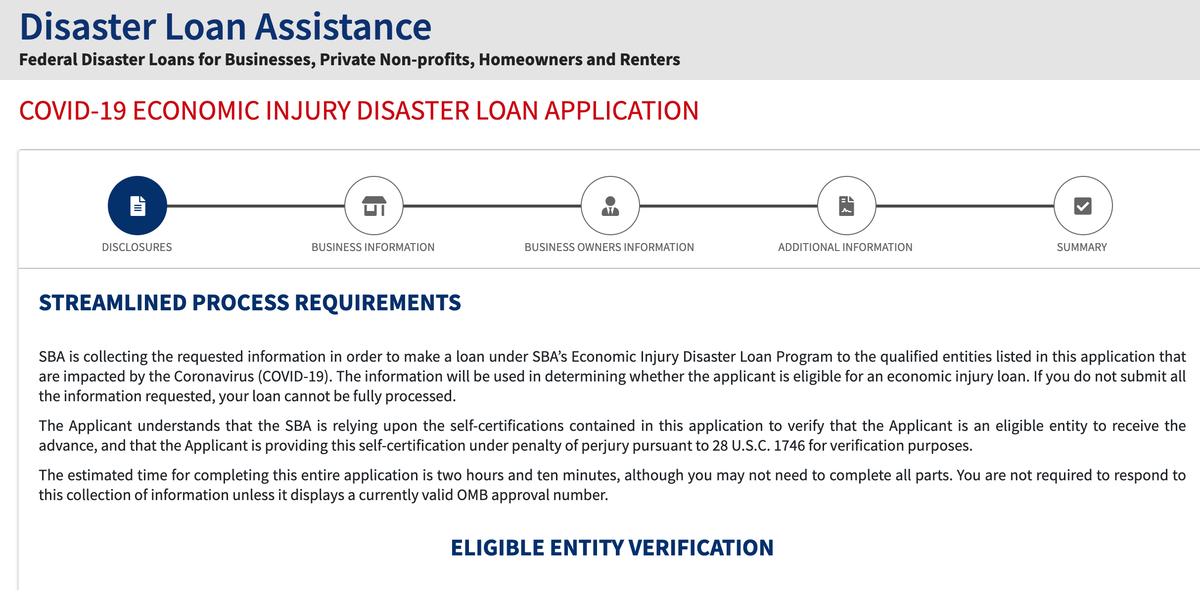

Cathy Oxenford, of Palmer Lake, has run the Touchstone surface cleaning and restoration business with her husband for five years. In March, she applied for an Economic Injury Disaster Loan through the federal Small Business Administration.

Applicants who qualify can receive up to $2 million at a low interest rate , to be repaid over 30 years. The loans are intended for small businesses that don't have employees.

"It wasn't until three weeks ago that I learned I was approved," Oxenford said. "After that, I heard nothing. Then, they told me I should have the money within 7 to 10 days. That was three weeks ago."

She said she had to take a $50,000 line of credit at her bank to meet expenses until her disaster loan for a similar amount comes in.

"I've lost 70% of my business," Oxenford said. "Businesses are cleaning more because of the pandemic, but they're saving money by doing it themselves even though they can't do it as thoroughly as we can. If I don't get that loan within a month, I'll be out of business."

A similar experience was shared in an email to KRDO NewsChannel 13 by Joseph Mason, of Colorado Springs, who said the company he works for applied for a disaster loan.

"After a month of waiting, we were informed we were approved for only $150,000, not the up to $2M that the CARE Act permits," he said. "I was told that the SBA was only approving up to $150,000 per small business in order to service more small businesses. SBA made this determination without requesting information from our company about how the COVID-19 impacted the company. Even though we were approved over two weeks ago, we have heard nothing from the SBA and received no funds."

The money for the loans comes from the U.S. Department of the Treasury, and the Small Business Development Center in Colorado Springs.

The center's executive director, Aikta Marcoulier, explains why processing of loans and applications is happening so slowly.

"We know that this process is far from perfect," she said. "We understand how the business owners feel. It is frustrating. But some of the delay could be due to errors in the paperwork. The slightest mistake can really slow things down."

Oxenford said her paperwork has no mistakes, but Marcoulier mentioned another possible factor.

"It could be that the lender hasn't sent confirmation of the bank account number to the SBA, and many times that's where a holdup can be," she said.

Marcoulier recommends that applicants who have a hard time reaching the SBA about the status of their loans or applications ask to speak with a loan officer.

"Because of privacy laws, only a loan officer can access someone's information," she said. "If applicants have questions, they should call us and we'll try to help them."

Marcoulier said the disaster loan program was initially overwhelmed by the sheer number of applicants but is now catching up to the workload.

The loan program was originally for local disaster victims, she said, such as after the 2012 Waldo Canyon Fire in Colorado Springs.

"The program covered a two-county area then," Marcoulier said. "Now, it's covering millions of struggling small businesses across the country. We should have been better prepared for this. But I can promise you we won't ever be this unprepared again."

In Colorado alone, she said, more than 14,000 applications have been approved so far, allocating $1.1 billion.